In the bustling world of finance, a new player has entered the game: AI trading. Have you ever wondered how AI trading works?

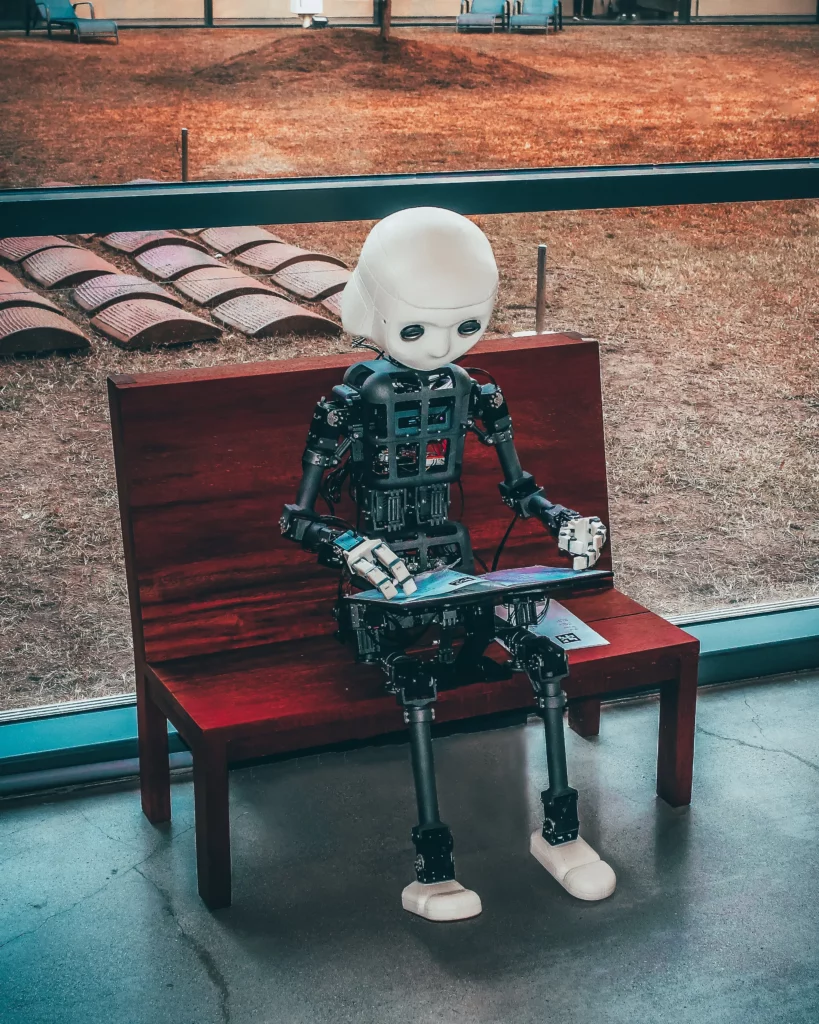

AI trading is like having a super-smart robot buddy who’s good at analyzing the stock market. It looks at much more data than any human could and spots patterns like hidden treasure maps, leading to smart investment decisions. But how does AI trading work?

It’s not magic but a blend of complex algorithms and machine learning. This means our robot buddy learns from past trades, getting smarter each day like you do in school! Think of it as a game of chess, where each move is a trade, and the AI is always thinking a dozen moves ahead.

It’s not about replacing human traders but giving them a high-tech helping hand. So, let’s dive into this fascinating world and uncover how AI trading changes our thoughts about money and investments. Ready to explore?

Exploring How does ai trading work?

Well, you’re not alone! AI trading, or artificial intelligence trading, is like having a super-smart computer that helps people decide about buying and selling stocks. It’s like having a friend who understands the stock market and can quickly process information.

The Magic Behind AI Trading

So, what makes AI trading so unique?

Imagine you have a giant jigsaw puzzle. It’s tough to solve it quickly. AI trading is like having a machine that can put this puzzle together in seconds.

It looks at tons of information from the stock market, like prices, trends, and news, and then makes smart guesses about what will happen next.

The Future of AI Trading

So, what does the future look like with AI trading?

It’s pretty exciting! We might see more people using AI to help them make better investments. It could make trading more accessible, even if you’re not a stock market expert.

Plus, as AI gets more innovative, it could start understanding the stock market even better than it does now. Moreover al trader plays an important role in this.

What are the risks of AI trading?

The Complexity of AI Decisions

First, let’s talk about how AI makes decisions. Imagine a robot trying to solve a super complicated puzzle, but this puzzle keeps changing every minute.

That’s how AI trading works. It’s complex; sometimes, even the smartest AI can make a mistake. If the AI gets its calculations wrong, it can lead to unexpected losses. It’s like guessing the wrong answer on a test when you’re confident you were right.

Speed vs. Control in AI Trading

One of the biggest thrills of AI trading is its speed. It’s like a race car zooming on the track, making trades faster than humans.

But what if this race car goes too fast and loses control?

The same can happen with AI trading. If the market changes suddenly, the AI might not react quickly or wisely enough, leading to potential losses.

The Risk of Over-Reliance on Technology

Here’s something to ponder: What if we rely too much on AI and forget to use our brains?

It’s like always using a calculator for math and failing how to do simple sums by yourself. If traders rely too much on AI, they might avoid using their judgment and experience, which can sometimes spot things that AI can’t.

Security Risks in AI Trading

Now, let’s remember security. In the digital world, there are hackers, just like in real life. If someone hacks into an AI trading system, they could cause a lot of chaos, like making bad trades on purpose.

It’s like someone sneaking into a control room and pressing all the wrong buttons!

What are the benefits of AI in trading?

In today’s fast-paced financial world, a burning question often arises: “What is the benefit of AI in trading?” It’s like asking, “Why use a super-fast computer instead of a regular calculator?”

In trading, AI, or Artificial Intelligence, is like having a lightning-fast brain analyzing the stock market. It’s not just about speed; there are several remarkable benefits that AI brings to the table.

Superhuman Speed and Efficiency

First off, AI operates at a speed no human trader can match. Imagine a robot that can read a library in minutes; that’s how AI processes market data.

It scans through vast amounts of financial information rapidly, making well-informed trading decisions in a fraction of the time it would take a human. This quick analysis helps in capitalizing on opportunities that might disappear in seconds.

Emotional Detachment: AI’s Rational Approach

One of AI’s most significant advantages is its lack of emotion. Human traders can get swayed by fear, excitement, or stress, but AI doesn’t have these feelings.

It’s like having a robot player in a soccer game who doesn’t get nervous or overexcited. AI sticks to its programmed strategies, providing a level of rationality and consistency that’s hard for humans to match.

Enhanced Risk Management

AI excels in identifying and managing risks. It’s like having a super-smart friend who can predict when it might rain and brings an umbrella just in case.

AI analyzes past market patterns and current trends to foresee potential risks, helping traders minimize losses and manage their portfolios more effectively.

Learning and Adapting: The AI Edge

Another cool thing about AI is its ability to learn and adapt over time. AI systems learn from past trades and market scenarios, continually refining and improving their decision-making processes. This learning capacity ensures that AI trading strategies evolve with the market.

Access to Complex Strategies

Lastly, AI opens up possibilities for complex trading strategies that are tough for humans to execute. It’s like playing a chess game with a computer that can imagine hundreds of moves ahead.

AI can analyze multiple variables and rapidly implement sophisticated strategies, which might need to be simplified or more time-consuming for human traders.

What is the difference between AI trading and human trading?

Have you ever thought about how computers and people trade stocks differently? Let’s explore the main differences between AI trading (where computers work) and human trading (where people make the decisions).

It’s like comparing a video game to a real sport – both have similar goals, but they’re played in totally different ways!

Super-Fast Computers vs. Smart People

First, let’s talk about speed. AI trading is like a super-fast video game character who can make moves quickly.

These computer programs can look at stock information in just a few seconds. It’s like they have superpowers to see and think fast! But human traders, like you and me, might take a lot more time to make decisions because we can only process information slowly.

Feelings Matter in Trading

Now, let’s think about feelings. When humans trade, they sometimes use their emotions or gut instincts. It’s like choosing your favorite ice cream flavor because you feel it’s the best. But AI doesn’t have feelings. It’s like a robot that only uses facts and data to make decisions.

This can be good because the AI won’t make rash decisions based on emotions, but sometimes, human intuition can be valuable, too.

The Best of Both Worlds

Ultimately, AI and human trading have their unique advantages. AI is super-fast and good at learning from lots of data, while humans bring their feelings and instincts into their decisions. The future might see us using both ways to make the best trades!

Conclusion:

Ultimately, AI trading is like a super-smart robot that helps make lightning-fast decisions in the stock market. It’s incredible how it can look at so much information and help people choose the best stocks.

It could be better, but it is an excellent helper for making those tricky money moves! Keep learning; maybe one day, you’ll use AI to help you with your trades, too!